fish-drink.ru

Learn

Whats The Status Of My Stimulus Check

You can check the status of your refund on Revenue Online(opens in new window). There is no need to login. Simply choose the option "Where's My Refund for. Using Where's My Refund is the easiest way to check on your refund. Your refund status may be available after: Two weeks for e-filers; 18 weeks for. How can I check the status of my payment? The IRS has an online portal you can use at fish-drink.ru It may not be available when you. Where's my refund? To check the status of your refund for the current taxable year visit the Taxation and Revenue Department's online service the Taxpayer. Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page. Using Where's My Refund is the easiest way to check on your refund. Your refund status may be available after: Two weeks for e-filers; 18 weeks for. To get an update on your claim, contact the Bureau of the Fiscal Service Call Center. Find out why you received a check from the government. Look for the. You may check the status of your refund using self-service. There are two options to access your account information: Account Services or Guest Services. You can check the status of any of your payments by going to (or creating) your IRS Online Account. This information was last updated in August Keep in. You can check the status of your refund on Revenue Online(opens in new window). There is no need to login. Simply choose the option "Where's My Refund for. Using Where's My Refund is the easiest way to check on your refund. Your refund status may be available after: Two weeks for e-filers; 18 weeks for. How can I check the status of my payment? The IRS has an online portal you can use at fish-drink.ru It may not be available when you. Where's my refund? To check the status of your refund for the current taxable year visit the Taxation and Revenue Department's online service the Taxpayer. Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page. Using Where's My Refund is the easiest way to check on your refund. Your refund status may be available after: Two weeks for e-filers; 18 weeks for. To get an update on your claim, contact the Bureau of the Fiscal Service Call Center. Find out why you received a check from the government. Look for the. You may check the status of your refund using self-service. There are two options to access your account information: Account Services or Guest Services. You can check the status of any of your payments by going to (or creating) your IRS Online Account. This information was last updated in August Keep in.

The exact amount of refund shown on your return (D Line 34). Select one of the following options: Check the status of your original income tax refund. If you've already filed, you can check your refund status using our Where's My Refund? tool, which is available 24/7! Skip the phone call and see your refund. You can see if your payment was deposited into your account via direct deposit, beginning on March 17th, , by checking your account via online banking or. It's easy to check on your tax refund. All you need is your Social Security number and refund amount for tax year Use the Check the Status of Your Refund. Find out how to track the latest stimulus check using the IRS's Get My Payment app, and learn what to do if you encounter any problems. To check the status of your Economic Impact Payment, please visit the IRS Get my Payment page; To check if you qualify for the Economic Impact Payment this. Where's My Income Tax Refund? Pennsylvania Department of Revenue. Begin Check the status of your Property Tax/Rent Rebate claim. Learn More · News. Keep reading to learn more about the eligibility requirements and how to check the status of your Surplus Refund. decorative image. How Do I Learn More About. The exact amount of refund shown on your return (D Line 34). Select one of the following options: Check the status of your original income tax refund. Keep reading to learn more about the eligibility requirements and how to check the status of your Surplus Refund. decorative image. How Do I Learn More About. The IRS created a Get My Payment portal so you can learn the status of your payment. To report missing checks or ask other questions, call the IRS at. If your refund amount is different than what is shown on your You may use our refund inquiry application to check the status of your current year refund. Call our automated refund system 24 hours a day and check the status of your refund by calling (Connecticut calls outside the Greater Hartford. Where's my refund? It can take up to 90 days to process your application and receive your credit. Check refund status. They should be prepared to provide their social security number, zip code and filing status reported on their returns when inquiring on their refunds. Checking. Learn how to check the status of your tax refund, request a direct deposit of your individual income tax refund, or contact DOR customer service. If you've already filed, you can check your refund status using our Where's My Refund? tool, which is available 24/7! Skip the phone call and see your refund. They should be prepared to provide their social security number, zip code and filing status reported on their returns when inquiring on their refunds. Checking. Where's My Income Tax Refund? Pennsylvania Department of Revenue. Begin Check the status of your Property Tax/Rent Rebate claim. Learn More · News. Keep a copy of the tax return available when checking on the refund status online or by telephone. Refer to the processing times below to determine when you.

Is Gerber Life Good

While Gerber Life's rating is very good, many other life insurance companies have superior financial strength ratings (A+ and A++). AM Best assesses a. Gerber Life has an overall rating of out of 5, based on over reviews left anonymously by employees. 76% of employees would recommend working at Gerber. The Grow-Up Plan is great, with a out of 5 overall rating and 86% of reviewers recommending it. See below for our most recent customer reviews. Gerber life insurance is one of the most recognized household life insurance names in United States and has consistently been a leader in providing term life. Yeah that sounds about right. I think it's basically a whole life policy that expires at Not a good investment at all that's why I didn't. Overall Rating: / 5 (Excellent). Gerber Life offers reliable, high-quality products backed by their company's outstanding financial stability. The Gerber Grow-Up Plan can provide life insurance coverage for children if the worst happens while they're growing up. It's a whole life insurance policy that. The Grow-Up® Plan is great, with a [rating] out of [max_rating] overall rating and [percent]% of reviewers recommending it. See below for our most recent. Gerber Life customers have spoken, and the word is they love it. Our Term Life has a out of 5 overall rating and 77% of reviewers recommend it. While Gerber Life's rating is very good, many other life insurance companies have superior financial strength ratings (A+ and A++). AM Best assesses a. Gerber Life has an overall rating of out of 5, based on over reviews left anonymously by employees. 76% of employees would recommend working at Gerber. The Grow-Up Plan is great, with a out of 5 overall rating and 86% of reviewers recommending it. See below for our most recent customer reviews. Gerber life insurance is one of the most recognized household life insurance names in United States and has consistently been a leader in providing term life. Yeah that sounds about right. I think it's basically a whole life policy that expires at Not a good investment at all that's why I didn't. Overall Rating: / 5 (Excellent). Gerber Life offers reliable, high-quality products backed by their company's outstanding financial stability. The Gerber Grow-Up Plan can provide life insurance coverage for children if the worst happens while they're growing up. It's a whole life insurance policy that. The Grow-Up® Plan is great, with a [rating] out of [max_rating] overall rating and [percent]% of reviewers recommending it. See below for our most recent. Gerber Life customers have spoken, and the word is they love it. Our Term Life has a out of 5 overall rating and 77% of reviewers recommend it.

Gerber Life customers have spoken, and the word is they love it. Our Whole Life has a out of 5 overall rating and 78% of reviewers recommend it. See below. The people and culture is great and fun, monthly meetings are great. Hardest part of the job is taking back to back calls and dealing with simple things like. Plus, their rate will never go up. This makes the Gerber Life Grow-Up® Plan a great and meaningful gift that can be bought by a child's parent, grandparent or. Life insurance reviews, wills reviews and more Worked smoothly, and is free. Easy to use. Easy to use. The information provided for completing my Will was. The Gerber Life Grow-Up Plan is a terrible product, one that preys on the hopes and dreams parents and grandparents have for their beloved little ones. Gerber Life Insurance Company has a long history of being there when our customers need us most. We have an “A” (Excellent) rating, most recently in June Gerber Life has a great guaranteed issue burial insurance plan that is easily one of the best guaranteed issued policy's available. Parents and grandparents everywhere agree. The Grow-Up® Plan is great, with a [rating] out of [max_rating] overall rating and [percent]% of reviewers. Gerber Life is considered a very reliable and stable company from a financial standpoint. Currently, they have an A rating (Excellent) from AM Best. Guaranteed Life Insurance is available for individuals aged , with no medical exams required. This policy guarantees acceptance regardless of health. Gerber Life received an A (Excellent) rating from AM Best for financial strength, meaning the company has historically paid out claims and met all financial. We work hard to provide great customer service and apologize that you have not had that experience. Please send additional information to: Gerber Life. Gerber Life offers several products that won't make sense for most families, such as child life insurance and endowment insurance, along with overpriced term. Gerber Life is a Reputable & Financially Stable Company When it comes to the plan itself, the Gerber Life Insurance Company's Guaranteed Life Plan is a fairly. Plus, their rate will never go up. This makes the Gerber Life Grow-Up® Plan a great and meaningful gift that can be bought by a child's parent, grandparent or. Highly Recommended By Customers of reviewers recommend the Gerber Life Term Life Insurance Plan. That's 23 of 30 reviews. Already have a Gerber Life Term. Gerber Life Term Life Insurance Reviews With its flexible options for coverage and premiums tailored to meet your budget, the Gerber Life Term Life Plan makes. The truth is: Gerber's guaranteed cash values would lock my daughter and me into a loss for nearly 40 years. gerber-grow-up-plan-child-life-insurance-cash-. The. Gerber Life customers have spoken, and the word is they love it. Our Term Life has a out of 5 overall rating and 77% of reviewers recommend it. See below. This organization is not BBB accredited. Life Insurance in Fremont, MI. See BBB rating, reviews, complaints, & more.

The New Economy

After the New Economy offers an accessible and entertaining account of the less-than-lustrous reality beneath the gloss of the s boom. Strategy · Sustainability on the seas – Part Two – Safety, labour and social | The New Economy · Sustainability on the seas – Part One – Preserving the. The New Economy refers to the ongoing development of the American economic system. It evolved from the notions of the classical economy via the transition. The New Economy. likes. The New Economy is a quarterly magazine and website, looking at technology and innovation in its wid. The Our New Economy (ONE) Foundation is an independent think tank based in Amsterdam, the Netherlands. Our mission is to disseminate the economic thinking. Together we can change the rules to protect the planet, share the wealth and give everyone a say in how the economy is run. The New Economy Fund (Class A | Fund 14 | ANEFX) seeks to provide long-term growth of capital. The New Economy Network serves as an open forum for groups and individuals engaged in economic development, diversification, and transition work in the seven. In The New Economy, Roger Alcaly describes how the economy has changed in response to new pressures and opportunities--created by new technologies, global. After the New Economy offers an accessible and entertaining account of the less-than-lustrous reality beneath the gloss of the s boom. Strategy · Sustainability on the seas – Part Two – Safety, labour and social | The New Economy · Sustainability on the seas – Part One – Preserving the. The New Economy refers to the ongoing development of the American economic system. It evolved from the notions of the classical economy via the transition. The New Economy. likes. The New Economy is a quarterly magazine and website, looking at technology and innovation in its wid. The Our New Economy (ONE) Foundation is an independent think tank based in Amsterdam, the Netherlands. Our mission is to disseminate the economic thinking. Together we can change the rules to protect the planet, share the wealth and give everyone a say in how the economy is run. The New Economy Fund (Class A | Fund 14 | ANEFX) seeks to provide long-term growth of capital. The New Economy Network serves as an open forum for groups and individuals engaged in economic development, diversification, and transition work in the seven. In The New Economy, Roger Alcaly describes how the economy has changed in response to new pressures and opportunities--created by new technologies, global.

Pathbreaking innovations are transforming the global economy, and emerging technologies are reshaping traditional industries and spawning new ones at a. The mission of the New Economy Initiative is to grow a culture of entrepreneurship in SE Michigan that benefits all residents and strengthens the economy. The Global Fund for a New Economy was founded in early by leaders from the new economy movement the world over. The founding was preceded by eighteen. THE NEW ECONOMY definition: activities based on knowledge and information, rather than traditional industries such as. Learn more. New Economy Project's mission is to build an economy that works for all, based on cooperation, social and racial justice, neighborhood equity. New Skills for a New Economy. New Skills for a New Economy, a project of PPI, seeks to promote workforce development policies that level the playing field for. The Global Commission on the Economy and Climate is a major new international initiative to analyse and communicate the economic risks and opportunities. A platform for leaders to shape prosperous, inclusive and equitable economies with opportunities for all. Economics is changing to try and solve these problems. New Economy Brief summarises robust, credible analysis to help you navigate political debate. Connecting people and ideas to address the world's most pressing challenges. Featured Sessions Episode Thumbnail Nov 17, Bloomberg New Economy Forum. In fact, an important dynamic of the new economy—the real new economy—is the virtuous cycle of competition, innovation, and productivity growth. Fierce. In this new economic order, success flows primarily from understanding networks, and networks have their own rules. In New Rules for the New Economy, Kelly. For more and more managers, who have been witnessing recent changes in their world, that new economy clearly has arrived. Bloomberg New Economy enables global leaders to come together to collaborate on solutions to shared challenges, establish deep personal connections. In this new economy, the Brazilian Amazon's total GDP is projected to increase by at least BRL 40 billion ($ billion) per year by above the reference. Technology. Citizens. Finance. Business. A global economic system in polycrisis. Transitioning to a new economy. Forces that may help or hinder the transition. “New Economy” is a term used for the first time in the nineties to describe the result of the transition, in the West countries, from a manufacturing-based. Partners for a New Economy is an international philanthropic fund focused on transforming our economy for nature and all people to flourish. We were founded in. The Los Angeles Alliance for a New Economy (LAANE) is an organizing and advocacy institution committed to economic, environmental, and racial justice. For the. In today's economy, you can't just be an employee looking to get hired—you have to market yourself as a business, one that can help another business achieve.

What Happens If You Dont File Income Tax

Key takeaways · Whether you have to file a tax return depends on your gross income, filing status, age, and dependent status. · You may only face a penalty if you. What happens if I don't file my tax report? If you fail to file a required tax report, the Comptroller's office will send you an estimated billing with. If you filed a tax return on time but didn't pay any owed taxes when they were due, the IRS will likely assess a penalty on you. The penalty for failing to pay. G.S. (e) requires a married couple to file a joint state income tax return if: They file a joint federal income tax return, and; Both spouses are. Late-filing fee: $50 · Delinquent interest: % per month (18% per year). · Negligence penalty for failure to timely file: 5% per month of the tax required to be. If you miss the tax-filing deadline and owe taxes, you may be on the hook for penalties and interest on any unpaid balance. If you don't file your taxes on. What happens if you file taxes late? A failure to file penalty is charged on tax returns with a balance due filed after the due date (Tax Day) or extended due. At its most extreme, your failure to file penalty can total 25 percent of your unpaid taxes. What Happens If You Don't Pay Taxes You Owe? The answer really. You should file all past due returns, even if you can't pay. I received a What happens if I don't pay on time? If we don't hear from you, we will. Key takeaways · Whether you have to file a tax return depends on your gross income, filing status, age, and dependent status. · You may only face a penalty if you. What happens if I don't file my tax report? If you fail to file a required tax report, the Comptroller's office will send you an estimated billing with. If you filed a tax return on time but didn't pay any owed taxes when they were due, the IRS will likely assess a penalty on you. The penalty for failing to pay. G.S. (e) requires a married couple to file a joint state income tax return if: They file a joint federal income tax return, and; Both spouses are. Late-filing fee: $50 · Delinquent interest: % per month (18% per year). · Negligence penalty for failure to timely file: 5% per month of the tax required to be. If you miss the tax-filing deadline and owe taxes, you may be on the hook for penalties and interest on any unpaid balance. If you don't file your taxes on. What happens if you file taxes late? A failure to file penalty is charged on tax returns with a balance due filed after the due date (Tax Day) or extended due. At its most extreme, your failure to file penalty can total 25 percent of your unpaid taxes. What Happens If You Don't Pay Taxes You Owe? The answer really. You should file all past due returns, even if you can't pay. I received a What happens if I don't pay on time? If we don't hear from you, we will.

Under the Code, the IRS may imprison you for up to 5 years, with a maximum fine of $, What happens if you just don't file for taxes? If you haven't. Failing to pay your taxes can come with a variety of serious penalties, fines, and possible criminal charges. Don't let your tax return sit on the back. An account becomes delinquent when the due date for a tax return or other established liability has passed and the amount due remains unpaid. Interest rates . For failure to file a return on time, a penalty of 5 percent of the tax accrues if the delay in filing is not more than 30 days. An additional 5 percent penalty. If you filed a tax return on time but didn't pay any owed taxes when they were due, the IRS will likely assess a penalty on you. The penalty for failing to pay. What Happens If I Don't File Back Taxes? If you have back taxes, it's important to file a past-due tax return as soon as possible. If you don't file or pay. The IRS is required to keep the filing open and hold on to unclaimed income tax refunds for three years. If you don't file for the tax refund after three. Can I Go to Jail for Not Filing Taxes? Technically, yes. Tax law includes the possibility of a year's imprisonment for every unfiled tax return. Realistically. FAILURE TO RESPOND TO THE NON-FILING INCOME TAX NOTICE BY THE DUE DATE MAY RESULT IN THE ISSUE OF A SUBPOENA OR A TAX FINDING BASED ON INFORMATION SUPPLIED BY. Late-filing fee: $50 · Delinquent interest: % per month (18% per year). · Negligence penalty for failure to timely file: 5% per month of the tax required to be. When there is an understatement of taxable income equal to 25% or more of gross income, the 25% large individual income tax deficiency or other large tax. Your tax returns are a crucial part of the documentation required. Therefore, if you don't have them, you are not able to get what you need. If you fail to file. You won't receive a tax refund if you don't file taxes. Even worse, you can lose your chance to get a refund. You have three years from the filing deadline to. What Happens If You Don't File or Don't Pay Several scenarios can lead to penalties and interest charges. The two main ones are filing your tax return late. “Not filing a tax return can create a penalty of 5% per month, up to 25%. This is based on the tax due,” Armstrong says. “The penalty for not paying or paying. You are immediately in trouble with the IRS if you don't file and you have a filing requirement. By failing to file, the statute of limitations. You don't need to do anything. If you had requested to have your After filing your Mississippi income tax return, if you receive an additional tax. If you live in a state that requires you to have health coverage and you don't have coverage (or an exemption), you'll be charged a fee when you file your The late filing penalty is 5% of the tax due for each month (or part of a month) your return is late (tax filing extensions are factored in). If your return is. What Happens If I Don't File Taxes? · You can incur failure-to-file penalties. · Interest will be assessed on your balance. · You may face liens, levies.

What Is The Average Price Of A New Car

The average price for cars increased from to 3. 4. 5. 6, Table 7, Average Price of a New Car (Domestic and Import), – 8. 9, Domestica. Research new and used car book values, trade-in values, ratings, specs and photos. Thankfully, according to recent data from Cox Automotive, the average transaction price for new cars in is $48, In other words, the average new car. With the Honda Payment Estimator tool, it's easier than ever to calculate monthly payments for financing and leasing options on new Honda models Build & Price. Research new car prices and used car values by make. Select a make. Select a car make below to get a valuation. Only the rich or fools buy new cars today. With the average new car price at close to $, affordability is tough for the average person. AAA evaluates factors that make up the cost of car ownership. Know what it really costs to own and operate a vehicle to make wiser choices when buying a new. Research new and used car book values, trade-in values, ratings, specs and photos. Consumer Price Index for All Urban Consumers: New Vehicles in U.S. City Average (CUURSETA01) ; Aug ; Jul ; Jun ; May. The average price for cars increased from to 3. 4. 5. 6, Table 7, Average Price of a New Car (Domestic and Import), – 8. 9, Domestica. Research new and used car book values, trade-in values, ratings, specs and photos. Thankfully, according to recent data from Cox Automotive, the average transaction price for new cars in is $48, In other words, the average new car. With the Honda Payment Estimator tool, it's easier than ever to calculate monthly payments for financing and leasing options on new Honda models Build & Price. Research new car prices and used car values by make. Select a make. Select a car make below to get a valuation. Only the rich or fools buy new cars today. With the average new car price at close to $, affordability is tough for the average person. AAA evaluates factors that make up the cost of car ownership. Know what it really costs to own and operate a vehicle to make wiser choices when buying a new. Research new and used car book values, trade-in values, ratings, specs and photos. Consumer Price Index for All Urban Consumers: New Vehicles in U.S. City Average (CUURSETA01) ; Aug ; Jul ; Jun ; May.

The Average New Car in the U.S. Now Costs $48, · Dataset · Data sources. According to the Kelley Blue Book, as of September , the average cost of a new car (or light vehicle) sold in the United States was $35, Ten all. Explore our lineup and prices of popular Subaru models, including the versatile Crosstrek, Outback, and Forester. Why wait? Find your next Subaru today! mean? Learn more about EVs · Ford Mustang Mach-E® in Grabber Blue · Mustang See your local dealer for vehicle availability and actual price. The. With the average price of a new car hitting $47, in October , chances are you'll need to take out an auto loan to cover some or most of the cost. Check out the next-generation MINI lineup, kicking off with the Countryman, along with a new all-electric MINI Countryman coming in July Register a New Business · Refunds · Audits and Collections · Tax Rules and Subject to the price/value of the vehicle. Mailing fee. $1. Special handling. The average price of a new car is more than $, and used cars go for about $—but fuel, insurance, and more also factor into how much you should. Electric car sales break new records with momentum expected to continue through Price gap between the sales-weighted average price of conventional and. *CarGurus meticulously monitors the prices of millions of pre-owned vehicle listings, offering users precise and up-to-date market insights. Used car price. Find new cars for sale, trucks and SUVs for sale as well as get a price on a new car What does "residual value" mean? Here are your answers. $ We take a look at the automotive market and analyze hundreds of thousands of listings to bring you the latest in pricing shifts and trends over time. The Average New Car in the U.S. Now Costs $48, The average transaction price for a new car in the U.S.. Key takeaway. Those looking for a cheap new car. In January , the average price of a new car was $49, and in December it was $48, average vehicle costs $11, per year to own and operate. The average car payment for new vehicles was $ per month in the first price index, while new vehicle prices dipped %. Americans borrow an. There's no doubt that buying a car is expensive. The average price of a new car is more than $45,, and a used car costs more than $26, on average. However. Want to Estimate the Cost of Your Plates? Get a Quick Quote. Agency Spotlight Icon. Fee Descriptions. Agency Spotlight Icon. Tax. Services (opens in new window) The purchase price you claim on documents you provide when registering your vehicle must state the price you actually paid. Only the rich or fools buy new cars today. With the average new car price at close to $, affordability is tough for the average person. A year ago, the average new car was priced at $45,, or percent above MSRP, but today the average new car is priced at $45,, or percent above MSRP.

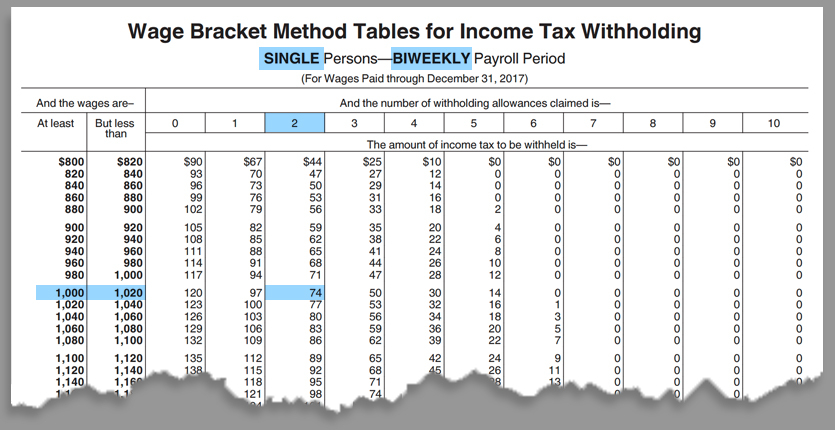

What Is A Federal Allowance On Payroll

b. Mandatory deductions for U.S. citizen personal services contractors (PSCs) include U.S. Federal, State, and local income taxes, U.S. Social Security taxes. amount of federal taxes that should be withheld from your paycheck. Use the withholding allowance certificates to help you determine the correct withholding. If you claim 0 federal withholding allowances, you'll receive less money every paycheck, but your tax bill will likely be reduced at the end of the year. When your Federal income tax withholding is calculated, you are allowed to claim allowances to reduce the amount of the Federal income tax withholding. In. In addition to being tax-exempt from Federal and State taxes, these allowances are also excluded from Social Security taxes. Explanatory Example. (Note: using. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer federal income tax per pay period and the. Form W An Employee's Withholding Allowance Certificate is how you let your employer know how much money to withhold from your paycheck for federal income. Federal withholding is money that is withheld and sent to the IRS to pay federal income taxes. It goes to pay for a number of programs, such as national defense. The value of a single allowance and how it impacts your salary is based on your tax bracket and how frequently you receive a paycheck. The exact amount of. b. Mandatory deductions for U.S. citizen personal services contractors (PSCs) include U.S. Federal, State, and local income taxes, U.S. Social Security taxes. amount of federal taxes that should be withheld from your paycheck. Use the withholding allowance certificates to help you determine the correct withholding. If you claim 0 federal withholding allowances, you'll receive less money every paycheck, but your tax bill will likely be reduced at the end of the year. When your Federal income tax withholding is calculated, you are allowed to claim allowances to reduce the amount of the Federal income tax withholding. In. In addition to being tax-exempt from Federal and State taxes, these allowances are also excluded from Social Security taxes. Explanatory Example. (Note: using. Withholding tax is income tax withheld from an employee's wages and paid directly to the government by the employer federal income tax per pay period and the. Form W An Employee's Withholding Allowance Certificate is how you let your employer know how much money to withhold from your paycheck for federal income. Federal withholding is money that is withheld and sent to the IRS to pay federal income taxes. It goes to pay for a number of programs, such as national defense. The value of a single allowance and how it impacts your salary is based on your tax bracket and how frequently you receive a paycheck. The exact amount of.

wages exempt from federal income tax withholding. Calculating Income Tax (Employee's Withholding Allowance Certificate) to calculate the amount to withhold. federal income tax purposes. You also will. Page 2. Illinois Withholding Allowance Worksheet. Step 1: Figure your basic personal allowances (including. federal and state taxes that are withheld from your gross pay each pay period For each withholding allowance you claim, you reduce the amount of income tax. NC-4 Employee's Withholding Allowance Certificate. Documents. Contact Information. North Carolina Department of Revenue. PO Box Raleigh, NC Learn more about withholding allowances and better understand your Form W-4 tax withholding, including allowances and exemptions, with help from H&R Block. What is a federal withholding allowance? Withholding is reserving money from an employee's paycheck and using those funds to pay the government for federal. State agencies and institutions of higher education must also honor an employee's request to withhold more federal income tax than would otherwise be withheld. Every employer who maintains an office or transacts business in Iowa and who is required to withhold federal income tax on any compensation paid to employees. federal form W-4 and should not use Colorado form DR An employee with federal withholding could have zero Colorado withholding if the annual allowance. The amount of tax withheld may vary depending on how many allowances an employee claims on the federal W-4 form and how often wages are paid. Employers should. The number of withholding allowances you claim determines the amount of your earnings exempt from taxation. Any pay calculated before your W-4 information is. If an employee qualifies for exemption from withholding, the employee can use Form W-4 to tell the employer not to deduct any federal income tax from wages. What is a federal withholding allowance? Withholding is reserving money from an employee's paycheck and using those funds to pay the government for federal. Gross taxable wages refers to the amount that meets the federal definition of wages contained in U.S. Code § Generally, this is the amount included in box. The higher the number of allowance, the less tax taken out of your pay each pay period. If you are a Federal Work Study student employee, please note this. Read the “Exploring key financial concepts” section to students. ▫ Distribute the “Understanding paycheck deductions” handout and give students time to read it. Allowances claimed on the Form W-4N are used by your employer or payor to determine the Nebraska state income tax withheld from your wages, pension, or annuity. If the federal form was used for Oregon withholding, then each allowance was equal to one personal exemption credit's worth of tax for the year on your Oregon. From this page you can modify your federal, state, and local tax withholding information. Page 4. 4. Update Federal Withholdings (Federal Form W-4). Pay · Payroll Services · Tax Information; Employee's Withholding Certificates (W-4) Why does it say "N/A" under Federal Allowances on my paycheck review in.

How To Lose 7 Kgs

Intermittent Fasting Diet Plan For Weight Loss | Lose 7 Kgs In 2 Weeks | % Effective Diet Plan. =========== Buy @EatmoreLosemore Products. 7 kilograms with a better body composition and is crushing her lifting goals!While Olivia admits there's been ups and downs (which are completely normal). How to lose weight 7Kg a month · Eat nothing after pm · Should drink lots of water, glasses a day. · Very low salt. · Allowed to use only one spoon of. Some studiesTrusted Source show that eating more protein when trying to lose weight can help older adults lose more fat and keep more muscle mass than if they. Your baby, for example, contributes about 7 to 8 pounds to your “weight On average, new moms lose around 13 pounds (6 kg) due to the baby's weight. Just diet for 2 months - only liquids and no oil, sugar or rice. Losing kgs is possible. +1 Zero Carb Diet Plan To Lose Weight Fast | Lose 7 Kgs In 7 Days | Full Day Indian Diet/Meal Plan For Weight Loss | Eat more Lose more. Intermittent Fasting Diet Plan For Weight Loss | Lose 7 Kgs In 2 Weeks | % Effective Diet Plan. =========== Buy @EatmoreLosemore Products. How I lost 7 kilograms in 15 days · 1. Cycling (10 minutes) · 2. Jumping on toes-: 5–10 minutes(depening on capacity/stamina — this builds up in a. Intermittent Fasting Diet Plan For Weight Loss | Lose 7 Kgs In 2 Weeks | % Effective Diet Plan. =========== Buy @EatmoreLosemore Products. 7 kilograms with a better body composition and is crushing her lifting goals!While Olivia admits there's been ups and downs (which are completely normal). How to lose weight 7Kg a month · Eat nothing after pm · Should drink lots of water, glasses a day. · Very low salt. · Allowed to use only one spoon of. Some studiesTrusted Source show that eating more protein when trying to lose weight can help older adults lose more fat and keep more muscle mass than if they. Your baby, for example, contributes about 7 to 8 pounds to your “weight On average, new moms lose around 13 pounds (6 kg) due to the baby's weight. Just diet for 2 months - only liquids and no oil, sugar or rice. Losing kgs is possible. +1 Zero Carb Diet Plan To Lose Weight Fast | Lose 7 Kgs In 7 Days | Full Day Indian Diet/Meal Plan For Weight Loss | Eat more Lose more. Intermittent Fasting Diet Plan For Weight Loss | Lose 7 Kgs In 2 Weeks | % Effective Diet Plan. =========== Buy @EatmoreLosemore Products. How I lost 7 kilograms in 15 days · 1. Cycling (10 minutes) · 2. Jumping on toes-: 5–10 minutes(depening on capacity/stamina — this builds up in a.

Find and save ideas about lose 7kg in 7 days on Pinterest. How to lose 7kg in 21 Days! at $ Read on your PC, Mac, smart phone, tablet or Kindle device. You're about to discover how to How to lose 7kg in 21 Days! Best weight loss tip for losing weight upto 12 kgs in a month. Proponents say that a GM diet is a low-calorie diet that can help you lose 5 to 7 kgs a week, purify your body, improve digestion, and even make you rest and. I started losing the most weight after reading the book Woman's weight loss secrets: the unspoken truth, a few things you are mentioning in this video are also. The DIET that helped this year-old's weight loss from 71 kgs to 54 kgs! TNN / Updated: Feb 9, , IST. The DIET that helped this year-old's. Lose 7kg in 1 week with this 10 minute workout! This 10 minute workout can be done anywhere as it does not require any equipment and can be. Lose weight consistently by following a calorie-deficit diet—this is when you burn more calories than you intake within a day. Eat a diet that's rich in whole. Most people can safely lose about 1 to 2 pounds weekly, which translates to about 7 to 14 pounds in seven weeks, according to obesity medicine and nutrition. We are going to explore the best way to lose 7kg of weight in a month. We will discuss diet changes, physical activity, and other lifestyle modifications. I'm sharing my personal regime which I followed during lockdown and successfully managed to lose 7 Kgs of weight in a month. 1. Set a target. It really helps to set a target of losing x kgs in y weeks/months and holding yourself accountable to it. · 2. Get a weighing. What i ate in a day to lose 7 kgs in 21 day while following Intermittent Fasting ❤️ #intermittentfasting #whatieatinaday. DILJIT DOSANJH · Kinni Kinni. Cutting carbs, eating more protein, lifting weights, and getting more sleep are all actions that can promote sustainable weight loss. fastweightloss #fatloss #diet #fattofit My 24kg Weightloss video: fish-drink.ru Intermittent fasting video. How To Lose Weight Fast 7 Kgs In 7 Days | Broom Diet | 7 Day Diet Plan For Weight Loss | Lose 7Kg in 7 Days | Summer Diet Plan For Weight. Zero Carb Diet Plan To Lose Weight Fast | Lose 7 Kgs In 7 Days | Full Day Indian Diet/Meal Plan For Weight Loss | Eat more Lose more===========Buy. If you have plan to lose 7 kg in 20 days, you have to stick to a complete fruit diet, that means you have to eat only fruits in breakfast, lunch and dinner. What i ate in a day to lose 7 kgs in 30 days doing Intermittent Fasting #weightloss #whatieatinaday. Sanju Rathod · Gulabi Sadi.

Bank Transfer Abroad

Transfer money. Choose your currency and destination country. Add your beneficiary details and click Send when you're ready. Send money to family and friends abroad with the Remitly app, and get a special offer on your first transfer! Trusted by millions worldwide, the Remitly app. Paysend. U.S. customers can send money to more than countries from its website or mobile app. Paysend provides a flat-fee structure of $2 per transaction. Sending money from India to overseas is made easy and convenient, with ICICI Bank's Money2World, an online outward remittance facility, to transfer money. Want to send money abroad online? Transfer the money internationally at fastest & safest way with IndusForex by IndusInd Bank. Unbeatable rate guaranteed. A wire transfer is a fast way to send money electronically to a domestic (U.S.) or an international recipient's bank account. What is a Remittance transfer? Select International, then choose the country of your recipient's bank account and the currency you will send. If you don't know the currency, the transfer will. Send an International Money Transfer in 3 Simple Steps. Sign in to RBC Online Banking or the RBC Mobile app and select International Money Transfer. Enter the. With TD Global Bank Transfer, you can send money abroad using your eligible TD Canadian or US dollar personal chequing, savings or line of credit accounts. Transfer money. Choose your currency and destination country. Add your beneficiary details and click Send when you're ready. Send money to family and friends abroad with the Remitly app, and get a special offer on your first transfer! Trusted by millions worldwide, the Remitly app. Paysend. U.S. customers can send money to more than countries from its website or mobile app. Paysend provides a flat-fee structure of $2 per transaction. Sending money from India to overseas is made easy and convenient, with ICICI Bank's Money2World, an online outward remittance facility, to transfer money. Want to send money abroad online? Transfer the money internationally at fastest & safest way with IndusForex by IndusInd Bank. Unbeatable rate guaranteed. A wire transfer is a fast way to send money electronically to a domestic (U.S.) or an international recipient's bank account. What is a Remittance transfer? Select International, then choose the country of your recipient's bank account and the currency you will send. If you don't know the currency, the transfer will. Send an International Money Transfer in 3 Simple Steps. Sign in to RBC Online Banking or the RBC Mobile app and select International Money Transfer. Enter the. With TD Global Bank Transfer, you can send money abroad using your eligible TD Canadian or US dollar personal chequing, savings or line of credit accounts.

You can transfer funds from your bank branch in person, send money from your desktop computer or use an app on your mobile device. Be sure to check with both. Free*, fast and convenient money transfers in all major currencies. Send money online via Internet Banking or over the phone. Online: Make international money. Fast, secure, low-cost international money transfer from the United States. Join 18 million happy customers and avoid high fees when you make an. International money transfers. Transfer money between your currency accounts. Benefits. Need to know. Overview. expandable section. Fees and charges. Fast, flexible and secure international money transfers across the world. Save time and money when you send money internationally with us. Our International Payments service is an easy and secure way to transfer money overseas. All online transfers to international bank accounts are now. We currently offer 2 ways to send money to accounts worldwide – through a Global Money Account in the app or by making an international payment in online. With Wells Fargo ExpressSend you can send money to 12 countries, with more than 40 Remittance Network Members, and over 49, payout locations. Economical. 1. Bank-to-Bank Transfers · 2. Wire Transfers · 3. Automated Clearing House Transactions · 4. Cash-to-Cash Transfers · 5. Prepaid Debit Cards. The secure, convenient and affordable way to transfer money* from India to students in Australia, Canada, Europe, United Kingdom, and United States. Based on. With Wells Fargo ExpressSend you can send money to 12 countries, with more than 40 Remittance Network Members, and over 49, payout locations. Economical. Send money internationally with speed and security through PayPal. Transfer money abroad to people in over countries, in a variety of currencies. What is Needed for an International Wire Transfer? · The recipient's full name and address · The amount of the wire transfer · Name and address of the. Send money with no HSBC fees with Global Money · Log on to the HSBC UK Mobile Banking app · If you already have a Global Money Account, select 'Pay or transfer'. Then click 'Send now' to begin to transfer money. Choose a country from the list of destinations and how much you want to send. Click on 'Bank account' to enter. Making an international wire transfer can seem a bit complicated. Read on to find out how to wire money abroad, as well as some cheaper alternative options! The cheapest and simplest way of sending money abroad is through an electronic transfer. You can use the free, fast International Moneymover Service which. RemitNow is a secure online Foreign Outward Remittance platform provided by HDFC Bank, which enables you to transfer money globally from the comfort of your. Send and receive money transfers internationally. Transfer money online securely with bank transfers, debit or credit cards, mobile wallet, and for cash. Once the transfer has been processed, the funds will usually be deducted from the sender's account. However, this doesn't necessarily mean that it will arrive.

Reit Stocks To Buy Now

Buying shares in real estate companies can give you the same benefits as investing in real property. You could be earning passive income from rental revenue and. Liquidity: Publicly traded REITs can be bought and sold on major stock exchanges with ease, making them far more liquid than direct property ownership. Time: In. Retail REIT Stocks FAQ · Retail Opportunity Investments (NASDAQ:ROIC) is the most undervalued retail reit stock based on WallStreetZen's Valuation Score. · Saul. And that's exactly what I'm doing right now. I'm bullish on the housing market and I thought stocks were overvalued. And guess what? As I revisit this post, the. Invest in world-class private market investments like real estate, venture capital, and private credit. Fundrise is America's largest direct-access. The best of the REITs–private or public REITs, U.S. or Canadian REITs–have good management and balance sheets strong enough to weather economic downturns like. As of [fish-drink.ru_weekends]. A real estate investment trust (REIT) is a company that owns, operates or finances income-generating real estate across a range. REIT Stock Investing and Analysis ; Whitestone: Growth At A Great Price · WSRKonstantinos Kosmidis ; Terreno Realty: Valuation Premium Makes It Inferior Pick In. Take a deeper dive into residential REIT stocks ; 1. Equity Residential (EQR) ·: $28,,, ·: ·: Buy EQR stock ; 2. Essex Property Trust . Buying shares in real estate companies can give you the same benefits as investing in real property. You could be earning passive income from rental revenue and. Liquidity: Publicly traded REITs can be bought and sold on major stock exchanges with ease, making them far more liquid than direct property ownership. Time: In. Retail REIT Stocks FAQ · Retail Opportunity Investments (NASDAQ:ROIC) is the most undervalued retail reit stock based on WallStreetZen's Valuation Score. · Saul. And that's exactly what I'm doing right now. I'm bullish on the housing market and I thought stocks were overvalued. And guess what? As I revisit this post, the. Invest in world-class private market investments like real estate, venture capital, and private credit. Fundrise is America's largest direct-access. The best of the REITs–private or public REITs, U.S. or Canadian REITs–have good management and balance sheets strong enough to weather economic downturns like. As of [fish-drink.ru_weekends]. A real estate investment trust (REIT) is a company that owns, operates or finances income-generating real estate across a range. REIT Stock Investing and Analysis ; Whitestone: Growth At A Great Price · WSRKonstantinos Kosmidis ; Terreno Realty: Valuation Premium Makes It Inferior Pick In. Take a deeper dive into residential REIT stocks ; 1. Equity Residential (EQR) ·: $28,,, ·: ·: Buy EQR stock ; 2. Essex Property Trust .

Real estate investment trusts, known as REITs, can help you hedge against stock market volatility. Retail REITs might catch your eye if you're interested in. Real estate investment trusts (REITs) allow you to invest in real estate without owning the properties. · There are two main classes of REIT: equity REITs and. Invest in world-class private market investments like real estate, venture capital, and private credit. Fundrise is America's largest direct-access. Liquidity: Publicly traded REITs can be bought and sold on major stock exchanges with ease, making them far more liquid than direct property ownership. Time: In. Stag Industrial (STAG): This ~$6 billion REIT is focused on industrial facilities, such as logistics companies and manufacturers over residential properties. Realty Income, Vici, STAG, and Digital Realty are all solid REIT plays. A Real Estate Investment Trust (REIT) is a security that trades like a stock on the major exchanges and owns—and in most cases operates—income-producing real. The Vanguard REIT Index Fund (VGSLX), which tracks the MSCI U.S. REIT Index, has a current yield of % as of September In today's low interest rate. Prologis has a dividend yield of %. The REIT beat on 3Q18 estimates, bringing in rental revenues of $ million versus $ million in the same quarter. As referenced earlier, you can purchase shares in a REIT that's listed on major stock exchanges. You can also buy shares in a REIT mutual fund or exchange-. The Reit sector is home to several prominent players. Some of the leading companies include Regency Centers, Federal Realty, Mid-America Apartment Communities. Largest Real-Estate-Investment-Trusts by market cap ; favorite icon, 7. Realty Income logo. Realty Income. 7O · $ B · $ % ; favorite icon, 8. Crown. REITs are typically listed on a national exchange and provide investors considerable liquidity. These securities invest in a portfolio of commercial real estate. REITs invest in the majority of real estate property types, including Register Now · About Nareit Open submenu. About Nareit · Leadership. Within the realty sector, the top gainers were MINDSPACE BUSINESS REIT (up %) and BROOKFIELD INDIA REIT (up %). On the other hand, EMBASSY OFFICE REIT . buy homes. Tue, May 21st BMO is buying the real estate dip. These stocks are on its buy list. Fri, May 10th Squawk on the Street · REITs outperform. Top 6 REITs for · Realty Income Corporation · 2. VICI Properties Inc · 3. Agree Realty Corporation · 4. Prologis, Inc · 5. Alexandria Real Estate Equities Inc. REITs invest in the majority of real estate property types, including offices, apartment buildings, warehouses, retail centers, medical facilities. The arrival of COVID in shook up the real estate investment trust (REIT) industry, but two companies weathered the storm and are now 3 Stocks to Buy.

Whats An Ach Transfer

ACH debit transfers are initiated by the person or organization that's being paid—the payee. When you authorize your mortgage lender to take your mortgage. An ACH payment is a payment sent via the Automated Clearing House network, an electronic network used to send paperless payments between bank accounts in. An ACH direct deposit is a type of electronic funds transfer made into a consumer's checking or savings account from their employer or a federal or state agency. ACH payments (also known as ACH transactions or ACH transfers) are bank-to-bank payments that take place electronically and only take place in the United States. An ACH transfer is a convenient way to move money around, without using checks, credit cards, or other methods. It enables direct deposits from employers and. An ACH transfer is an electronic transaction that moves funds directly between banks without the need for paper checks, usually completing within a day. This guide has all you need to know about ACH transfers — including ACH international transfer processes, and providers. ACH payments are easy to create. In a few clicks, you can start collecting money from customers and transferring money in a secure, reliable fashion. ACH payment is a way to transfer money electronically between US bank accounts via the ACH network. PayPal uses this network for US bank account payments. ACH debit transfers are initiated by the person or organization that's being paid—the payee. When you authorize your mortgage lender to take your mortgage. An ACH payment is a payment sent via the Automated Clearing House network, an electronic network used to send paperless payments between bank accounts in. An ACH direct deposit is a type of electronic funds transfer made into a consumer's checking or savings account from their employer or a federal or state agency. ACH payments (also known as ACH transactions or ACH transfers) are bank-to-bank payments that take place electronically and only take place in the United States. An ACH transfer is a convenient way to move money around, without using checks, credit cards, or other methods. It enables direct deposits from employers and. An ACH transfer is an electronic transaction that moves funds directly between banks without the need for paper checks, usually completing within a day. This guide has all you need to know about ACH transfers — including ACH international transfer processes, and providers. ACH payments are easy to create. In a few clicks, you can start collecting money from customers and transferring money in a secure, reliable fashion. ACH payment is a way to transfer money electronically between US bank accounts via the ACH network. PayPal uses this network for US bank account payments.

ACH transfers are quick, free, and more convenient than writing a check or paying a bill with a credit or debit card. A wire transfer is a direct bank to bank electronic transmission of money that requires both banks to verify the accounts and funds to be transferred. 2. ACH credit transactions let you "push" money online from another bank or institution to your Green Dot account. For example, if you elect to have your IRS or. ACH transfers are generally cheaper, more secure and more convenient than payments by card, check or wire transfer, but they do come with some limitations. EFT stands for Electronic Fund Transfer and is the backbone of the Canadian payment industry. ACH stands for Automatic Clearing House. ACH (Automated Clearing House) is a payment processing network that's used to send money electronically between banks in the United States. An ACH payment is an electronic payment made from one bank to another. An employer that uses direct deposit authorizes payments from its bank account to its. ACH Debit, or direct payment, is an alternative to paying a merchant or employer with cash. Payments are initiated by granting someone (such as a business). When a customer pays you through ACH, that electronic funds transfer (EFT) will show up in your bank account as a direct deposit or direct payment. However, ACH. In this guide, we'll explain what an ACH transfer is, outline the different types of ACH transfers, and supply some basic steps on how to set up ACH transfers. In this blog we'll look at the various ways in which to transfer funds, and highlight the key differences between each payment processing method. An ACH payment is a way of transferring money between financial institutions that uses the ACH financial network to quickly move money between bank accounts. ACH payments are limited to domestic transactions, are generally free and may take one to three business days to process. In this blog we'll look at the various ways in which to transfer funds, and highlight the key differences between each payment processing method. What are ACH payments? An ACH payment is an electronic transfer between bank accounts that is handled by the ACH network. This payment can be to or from a. The ACH system is designed to process batches of payments containing numerous transactions, and it charges fees low enough to encourage its use for low-value. ACH payments (also known as ACH transactions or ACH transfers) are bank-to-bank payments that take place electronically and only take place in the United States. Wait for Processing to Complete. It may take several business days for the transaction to be credit to your checking account. There is no fee charged by us for. An ACH transfer is a convenient way to move money around, without using checks, credit cards, or other methods. It enables direct deposits from employers and.

1 2 3 4 5 6 7